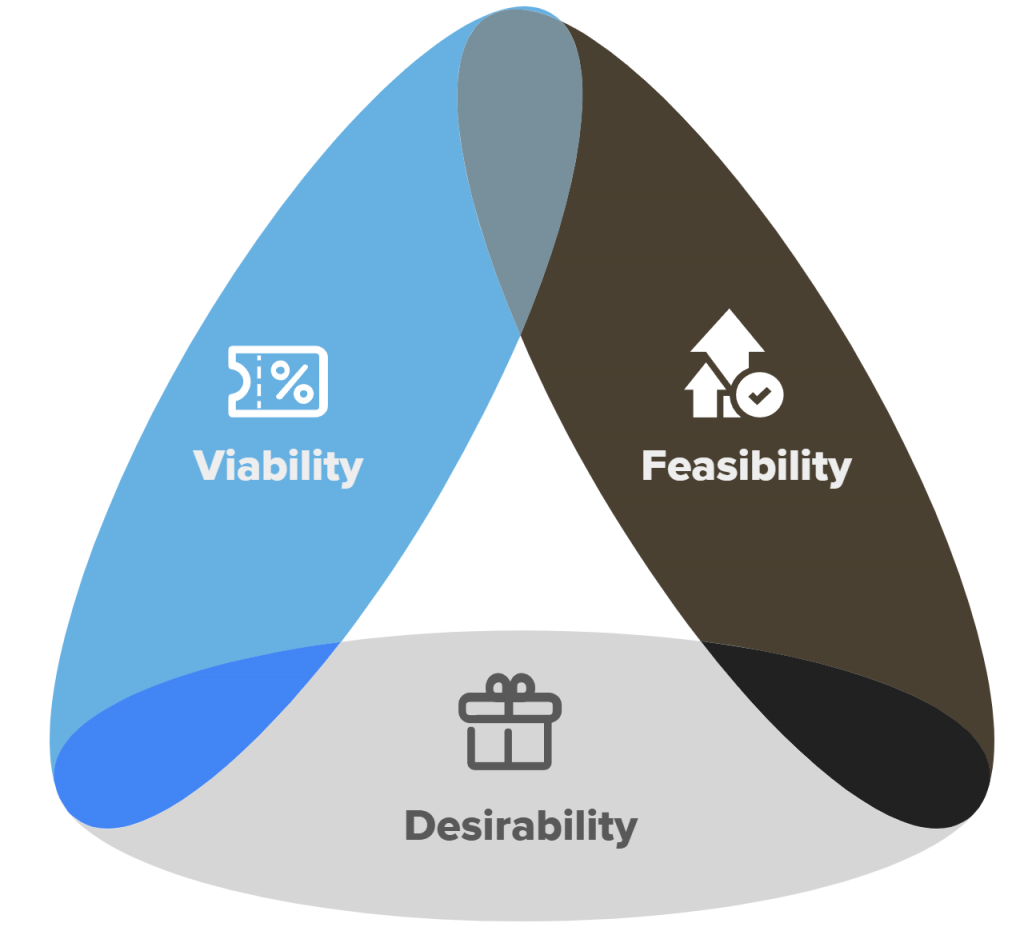

There are three types of risk that need to be managed when exploring, testing and bringing products and accelerators to market: viability, desirability and feasibility.

Accelerator ideas originated from technical teams should pay special attention to desirability risk, as this is the most common pitfall to watch out for.

Desirability

Accelerator ideas with high desirability risk can be described as “solutions in search of a problem”. Often, these ideas have their genesis with technical team members who are excited to try out a newly emerged technology. While this isn’t necessarily a poor origin in of itself, the accelerator needs to address a real customer pain point or deliver a meaningful gain.

Even if there is a measurable benefit to the business by using a proposed accelerator, the problem may not be a significant portion of the target customer’s business. For example, an elegant accelerator with an easy to understand ROI won’t be prioritized if it optimizes only 1% of a prospect’s business. Prospects will prioritize high value solutions that will address 80% of their most urgent objectives.

Feasibility

Accelerator feasibility risks are shrinking everyday. In recent years, we have witnessed multiple waves of developments that have reduced technical barriers to build new products: open source, cloud, low-code platforms, AI and more. Often, the answer to “could we build it?” is “yes”.

The more common types of feasibility risk barriers to watch out for today have to do with access to data, and key partnerships. For example:

- Will you be able to access the customer information you need?

- If you need to handle personally identifiable information, will you be authorized to do this?

- Will you be able to meet information security requirements and legal requirements?

- Will you be able to get permission to use 2nd party data (e.g. data clean room)?

- Will you get the support you need from channel partners and other stakeholders (e.g. sales)

Viability

Accelerator viability risk refers to how quickly you can earn and sustain a profit.

Accelerator pricing an entire discipline in of itself, but showing price flexibility, while remaining focused on customer value is a winning formula. Instead of following the playbook of the venture capital backed unicorn SaaS success stories, consider alternative incremental steps to proving viability:

- Use the accelerator as a lead generator only – no direct revenue. The accelerator is included as a tool provided by your team during professional services engagements

- Perpetual license for small accelerator, which is installed and maintained primarily by the customer. You provide only limited 3rd party support

- Limited functionality version of accelerator that may be purchased and deployed within marketplace of an existing software vendor platform (no compute or storage provisioning required)

- Limited offering, which only runs within customer’s existing infrastructure

Aside from the initial development investment, it is important to consider the ongoing operational costs for maintaining your accelerator with live customers. While some infrastructure costs are easy to forecast, be warry of 3rd party services you have built your solution on, which may be able to dramatically increase their price over time (e.g. private LLM models).